Recently, the Chinese interest rate bond market has experienced increased volatility. Although the overall yield has been trending downward since July, the market sentiment is still swayed by the actions of the central bank. How will this affect the enthusiasm of foreign institutions for purchasing Renminbi bonds?

Data indicates that the inflow of funds into Chinese government bonds has rebounded as the spread between the 10-year Chinese and US interest rates narrows. However, in July, the share of Chinese government bonds held by foreign investors further declined to 7.16%, the lowest level in 77 months. "This is because, as China continues to issue 1 trillion yuan in ultra-long-term special government bonds, the size of the bond stock continues to grow, while the demand from foreign investors for Chinese government bonds remains lukewarm," said Stephen Chiu, Bloomberg's Chief Asia FX and Rates Strategist, to reporters.

Nevertheless, foreign interest in Chinese interbank deposit certificates (NCDs) remains strong, and Panda bonds have also become favored targets. Several traders have noted that the share of NCD holdings by foreign investors is approaching that of Chinese government bonds.

The volatility of government bonds has intensified, and the bullish sentiment has cooled.

High-frequency data shows that the overall economic data for August is relatively weak, with the bright spots being the positive turnaround in exports and sales in first-tier real estate markets. Against the backdrop of an economy that still needs to stabilize, institutions' willingness to take long positions in the bond market is not low. However, given the central bank's multiple warnings about the risks of crowding in long-term bonds, the overall bond market yield has been fluctuating at a low level recently.

Advertisement

As of the close on the 27th, the yield on 30-year government bonds was reported at 2.379%, and the yield on 10-year government bonds was reported at 2.185%. Over the past week, different bond varieties have shown divergent trends, with the government bond yield curve shifting downward by about 4 basis points (BP), the 10-year government bond falling 4 BP to 2.15%, while credit bonds, certificates, and bank perpetual bonds rose by 3 to 6 BP. Behind the market segmentation, on the one hand, the Traders Association has clarified market misinterpretations, and on the other hand, it is due to the convergence of funds and the fluctuation of liabilities of asset management products.

Wang Qiangsong, the head of the research department at Nanjing Wealth Management, told reporters that most of the high-frequency economic indicators in August were relatively weak, and the upcoming shift in Federal Reserve policy is conducive to reducing pressure on the Renminbi exchange rate. Domestic monetary policy also supports the bond market, and considering the issue of a relatively small net supply of credit bonds, the bond market is still in a bull market. However, recently, due to the increased attention of regulators to interest rate risks, coupled with the increased volatility of funds (the average value of overnight funds R001 in the past month has been above 1.8%), various factors have led to increased volatility in the bond market. The liquidity of interest rate bonds has shrunk significantly in the past week, and the overall bullish sentiment in the bond market is cooling.

Since August, the bond market has also seen several significant sell-offs. For example, on the 12th, the main contract for 30-year government bond futures fell by 1.11%, the main contract for 10-year government bonds fell by 0.59%, and the main contract for 5-year government bonds fell by 0.34%; on the 8th, the main contract for 30-year government bond futures fell by 0.52%, and the main contract for 10-year government bonds fell by 0.27%.

Regulators have made consecutive statements recently. On August 7th, the National Association of Financial Market Institutional Investors indicated that through monitoring, it was found that Jiangsu Changshu Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Jiangsu Kunshan Rural Commercial Bank, and Jiangsu Suzhou Rural Commercial Bank were suspected of manipulating market prices and transferring interests in the secondary market trading of government bonds.

On the 10th, the central bank mentioned in a special column of the second-quarter monetary policy implementation report that since the beginning of this year, the long-term bond interest rates in China have fallen, and the long-term bond allocation of some asset management products has increased. The annualized return of some asset management products, especially bond-type wealth management products, is significantly higher than the underlying assets, mainly achieved through leverage, which actually poses a significant interest rate risk. When market interest rates rise in the future, the net value of related asset management products will also retract significantly.On the 21st, Xu Zhong, the deputy secretary-general of the Securities Association, stated that there are currently three misconceptions in the bond market, such as the belief that the central bank needs to control and determine the level of government bond market interest rates. It is necessary to clarify these misunderstandings. He also indicated that some financial institutions have "blanket" suspended government bond trading after the central bank's risk warnings, which is not only a reflection of their weak risk management capabilities but also a misinterpretation of the central bank's intentions.

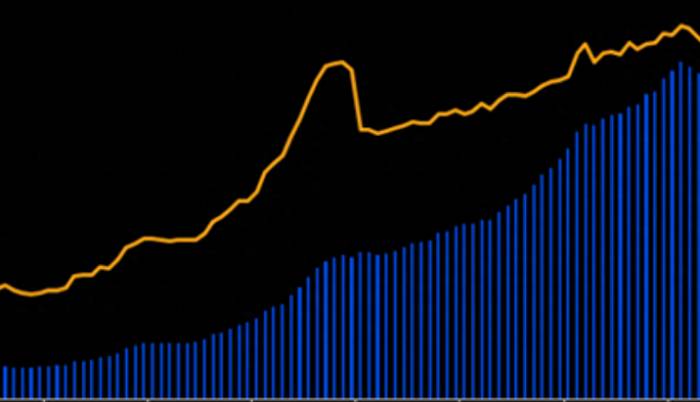

Foreign Holdings of Chinese Government Bonds Decline

This year, foreign investors have returned to the Chinese bond market, but have recently slowed down their pace. In July, the share of Chinese government bonds held by foreign investors was 7.16%, reaching a new low in 77 months.

However, this is mainly related to the increase in bond supply. In July, the holdings of Chinese government bonds by foreign investors still increased by 30.5 billion yuan, marking the second increase in six months; holdings of local government bonds and policy bank bonds have declined, with the latter recording a decline for the first time in five months. In the same month, fund institutions were the main buyers of government bonds, local government bonds, and policy bank bonds, while commercial banks have reduced their purchases of these bonds, especially government bonds.

It is worth mentioning that the inflow of foreign capital into certificates of interbank deposits is the largest, and the term of this asset is usually within one year. Therefore, it may not be the target of bond intervention by the People's Bank of China, and it can be used by investors to prepare for further easing of monetary policy.

Stephen Chiu told reporters that this year, foreign investors have significantly increased their purchases of certificates of interbank deposits, with the share of holdings rising to 6.15% by the end of July, the highest level since at least 2015, slightly lower than their holdings of Chinese government bonds (7.16%). Certificates of interbank deposits may even surpass Chinese government bonds to become the second-highest financial instrument in terms of foreign investors' holdings among all types of Chinese bonds.

Panda bonds are the bond type with the highest share of holdings by foreign institutions, reaching 17.5% by the end of July, lower than the historical high of 25.4% at the end of December 2021. Panda bonds are a type of renminbi-denominated bond issued by foreign issuers within China.

Cheng Hao, fixed income fund manager at Fidelity Fund Management (China), said to reporters: "We expect interest rates to remain in a downward channel. However, since interest rates have already declined significantly in the first half of the year and are at a historical low, the pace of further decline may be more tortuous than before, and investment also needs to consider the central bank's risk warnings and practical impacts on long-term interest rates. For the allocation of interest rate bonds in the future market, we believe that bond supply is an important factor and a risk point to pay attention to, because the reasons behind the current speculation on some long-term government bonds actually come from the lack of assets, and the market's demand for bond allocation is far greater than the supply."

In this context, foreign capital has begun to explore some more niche varieties and less crowded tracks. Cheng Hao said, for example, that liquidity of panda bonds has improved this year under the compression of other conventional varieties, and asset-backed securities (ABS) are also directions that will be considered in the allocation.Another trend has also attracted attention. Over the past year, a mainstream strategy of foreign investment institutions has been to lock in forward exchange rates by engaging in foreign exchange swaps to buy domestic bonds. There is concern that recently, as the Chinese yuan has appreciated in stages, the swap points have returned from around -2900 to within -2300. For foreign capital, the excess returns from carry trades have narrowed to within 50 basis points, which may slow the pace of incremental foreign capital inflow into the domestic bond market.

Wang Ju, Head of Currency and Interest Rate Strategy for Greater China at BNP Paribas, mentioned in a recent report that it is necessary to pay attention to the adjustment of positions in the Renminbi bond asset swap (ASW). The correction in the bond market, coupled with the recent cleanup of Renminbi financing arbitrage transactions, may impact the ASW positions in Renminbi bonds.

She mentioned that from November of last year to August of this year, foreign investors have purchased nearly $140 billion worth of domestic Renminbi bonds (with a net amount of $18 billion, and government bonds, policy bank bonds, and certificates of deposit accounting for $3 billion, $9.5 billion, and $1.8 billion, respectively) through such transactions.

"We believe that 80% of the inflow is related to ASW. As the domestic foreign exchange swap points climb rapidly, the one-year government bond ASW spread has narrowed significantly from SOFR (the secured overnight financing rate for U.S. Treasury bonds) +112 basis points at the beginning of August to SOFR +50 basis points. This could lead to an increase in profit-taking by participants and will impact short-duration bonds (large-amount certificates of deposit and 1 to 3-year bonds)."

Huaxi Securities previously mentioned that the difference between the forward exchange rate and the spot exchange rate is the swap point. For example, on July 31, 2024, the one-year U.S. dollar to Renminbi swap point closing price was -2892 basis points, with a spot exchange rate of 7.2261, corresponding to a forward exchange rate of 7.2261 - 0.2892 = 6.9369. It can be inferred that the implied interest rate difference between the two countries' government bonds in the forward exchange rate is -4%, but at that time, the one-year interest rate difference between Chinese and U.S. government bonds was -3.31%, which means there was an excess interest rate difference of 69 basis points.

Foreign investors, through one-year swap transactions, give up spot U.S. dollars to obtain spot Renminbi and invest in one-year Chinese government bonds. Upon maturity, they reverse the exchange at the previously agreed forward exchange rate and can achieve a return of 5.42% (4.00% + the one-year government bond yield of approximately 1.42%), which is higher than the return on investing in one-year U.S. Treasury bonds, which is 4.73%. If they invest in one-year interbank certificates of deposit, the corresponding return can be as high as 5.88%.

The institution stated that considering that since the fourth quarter of 2023, interbank certificates of deposit have accounted for 65.8% of the domestic bonds increased by foreign institutions, there may also be a portion of short-term government bonds, and it is speculated that the proportion of medium to long-term bonds is not high. Therefore, fluctuations in the spot exchange rate or interest rate differentials will not affect most of the existing transactions; the main impact is on the incremental inflow of funds. Recently, as the Renminbi has appreciated in stages and swap points have rebounded, for foreign capital, the excess returns from carry trades have narrowed to within 50 basis points, which may slow the pace of incremental foreign capital inflow into the domestic bond market.

Comments