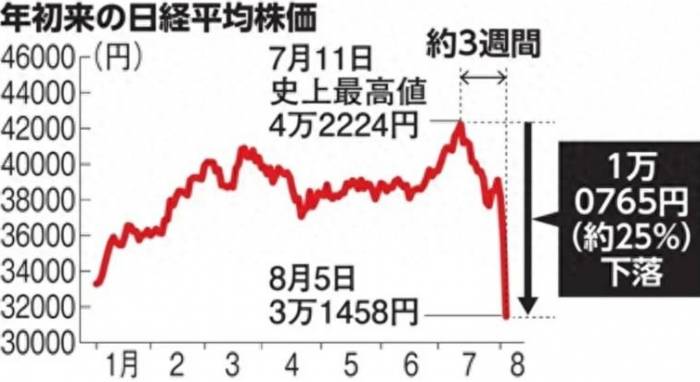

Entering August 2024, the Japanese stock market has been like a roller coaster, first experiencing a "Black Monday" on August 5th—when the stock prices plummeted from 42,224 points on July 10th to 34,675 points on this day. Purely in terms of fluctuation, the decline has already surpassed the "Black Monday" of October 19, 1987, in the United States.

Another factor is the exchange rate. On January 1, 2024, the exchange rate of the US dollar to the Japanese yen was 1 US dollar for 140 yen, which rose to 161 yen by July 2nd, with the yen depreciating by nearly 14% in just over half a year. By August 5th, the exchange rate returned to 144 yen, almost at the starting point of the New Year. The ups and downs have affected the stability of the financial market due to the changes in the Japanese exchange rate.

On Monday, August 26th, the Japanese stock market opened around 38,156 points, with an exchange rate of 1 US dollar for 143.7 yen, seemingly stabilizing. However, there has been no technological innovation wave in Japan's real economy, and the relative depreciation of the yen has not led to an increase in exports.

The risk of a Nankai Trough earthquake with a magnitude of over 9, coupled with the upcoming Liberal Democratic Party presidential election in September, has made social and industrial policies increasingly unstable, further destabilizing the country's finance and depriving economic development of its necessary conditions for progress.

Advertisement

It is necessary here to review the financial turmoil in Japan since the beginning of August, analyze the causes of the turmoil and the countermeasures taken by the Japanese government, and provide a brief outlook on the future of Japan's finance.

01

Main Manifestations of Financial Turmoil

"In just over three weeks, stock prices have dropped by 25%" "The yen exchange rate has risen from 160 yen per US dollar to 141 yen (an appreciation of more than 10%)"... On Monday, August 5, 2024, a major financial earthquake hit Japan, causing the country to tremble.

Too many people have only seen the term "Black Monday" in books without experiencing it firsthand. On Monday, October 19, 1987, a massive global stock market crash occurred, causing the US stock market to fall by 22.6% that day. At that time, there was no circuit breaker mechanism, and the tsunami of heavily sold stocks that flooded into the stock market led to trading interruptions and exacerbated the crisis.

By the end of October of the same year, the stock markets in Hong Kong, China, had fallen by 45.5%, Australia by 41.8%, Spain by 31%, the United Kingdom by 26.45%, the United States by 22.68%, and Canada by 22.5%. The stock market crash had a profound impact on the economies of the relevant countries and regions over several years.Compared to the "Black Monday" of 1987, the financial turmoil of 2024 was even more intense, with Japan being hit the hardest and becoming one of the most severely affected countries in the financial earthquake. After the financial crisis of 1987, Japan provided liquidity to prevent the impact of the financial crisis on the real economy and was the first to emerge from the crisis.

Financial confidence led to a unique situation in the Japanese stock market, which reached an unprecedented boom by the end of December 1989. However, it was this financial confidence that caused the Japanese stock market bubble to collapse starting in 1989, taking 35 years to surpass the highest value of December 1989 again on July 11, 2024, reaching 42,224 points. Unfortunately, within a little over three weeks, by August 5, the index had fallen to 31,458 points, a drop of 25%.

Following the precedent of the 1987 "Black Monday," the stock market downturn could last for several weeks to months, with the recovery period taking several years to decades. But what about Japan? It seems not to take too much time, as there have already been whispers in the Japanese financial community that the Japanese stock market could break through the 40,000-point mark again.

Looking at Japan today, any slight change in the U.S. stock market or interest rates can trigger a financial earthquake in Japan. Compared to 1987, Japanese society has lost its momentum for technological innovation, and its manufacturing capabilities are not what they used to be. In the past two years, the Japanese stock market has flourished under the guidance of national policies, which is less an economic phenomenon and more a result of financial policies, unrelated to the real economy of Japan.

When the real economy becomes disconnected from finance and finance runs amok, the occurrence of a stock market collapse or a major financial upheaval is only a matter of time.

With Japan's current government policy capabilities, business management models, and public financial resources, rescuing the Japanese stock market is by no means an easy task. The financial earthquake has brought political turmoil to Japan, and Prime Minister Fumio Kishida suddenly announced on August 14 that he would not participate in the autumn Liberal Democratic Party (LDP) presidential election, with political turmoil already evident in Japan.

More than ten candidates are participating in the LDP presidential election, with each taking turns to make their case, causing the country to increasingly lose its ability to function effectively in terms of economic and financial policies, which could potentially exacerbate the consequences of financial turmoil.

02

"Black Monday" and Its Connection to the United States

The Japanese media tends to attribute the cause of "Black Monday" to the United States.First, the increase in U.S. interest rates has led to the strength of the dollar and the weakness of the yen exchange rate. Japanese companies, such as those in the automotive industry, have significant investments abroad. The weakness of the yen has resulted in a premium phenomenon when the profits earned by these companies abroad are converted back into yen, effectively providing them with additional benefits. The stock market immediately responded, and in the past two years, the share prices of Japanese companies on the Tokyo Stock Exchange have risen quickly, leading to a boom in the Japanese stock market.

However, on July 31, 2024, the Federal Reserve (FRB) announced the possibility of lowering bank interest rates in September. Consequently, the premium on the profits of Japanese companies abroad would be affected, and the stock market reacted accordingly, with share prices experiencing a certain degree of decline, which was a natural occurrence.

Moreover, following a U.S. interest rate cut, Japan would need to raise interest rates. When the U.S. raises rates, it causes an influx of dollars into the country, strengthening the dollar and weakening the yen; after a U.S. rate cut, the dollar weakens, and the yen strengthens, providing Japan with an opportunity to boost the yen and allow it some respite from its over-weakness.

The Bank of Japan quickly made a decision to raise the target for short-term interest rates from 0-0.1% to 0.25%. In other words, the yen interest rate will rise above the horizon, offering the opportunity to earn 0.25% interest. Moving away from a zero-interest rate is a significant financial breakthrough for Japan.

However, the yen's appreciation from 160 yen per U.S. dollar to over 140 yen was somewhat unexpected by Japanese financial authorities.

Second, the layoffs at Intel Corporation in the United States have subtly made the Japanese stock market sense the possibility of a shift from overheating to cooling in IT or AI (Artificial Intelligence). Although the U.S. manufacturing industry has experienced a significant decline in recent years, the U.S. IT and AI sectors have not weakened; instead, under the strong protection of the U.S. government, they have emerged with new opportunities.

Japan holds a pivotal position in the world in terms of semiconductor manufacturing equipment and materials. In conjunction with the U.S. policy of decoupling and severing supply chains with China, suppressing China's semiconductor industry, and building a completely new supply chain outside of China, this presents a new business opportunity for Japan. Japan's most important industrial policy is primarily focused on the semiconductor sector, and the suppression of China seems to be within reach.

However, U.S. AI companies have not brought about a new economic boom. The layoffs at Intel quickly became associated with the U.S. stock market's sell-off of AI stocks, affecting Japan's most important semiconductor equipment manufacturing companies, such as Tokyo Electron. Semiconductor stocks were the most severely sold on the 5th of August on the Tokyo Stock Exchange.

Third, the deterioration of employment conditions in the United States has further exacerbated the situation in the stock market. On August 2, the United States released employment statistics for July. The results showed a significant deviation from market estimates, leading to a pessimistic outlook on the U.S. economic future. The New York market began selling off stocks, and the stock prices fell by 610 points on that day. Combined with the decline on August 1, there was a total adjustment of 1100 points over two days.

August 3rd and 4th were Saturday and Sunday, with no stock market trading. On August 5th, Japan, located in the East, opened the market first. Originally, on the 2nd, the Nikkei average stock price had already fallen by 2216 points. On the 5th, it entered a full green (downward stocks are indicated by green) phase, and the entire trading screen could not find a single point of red. A financial tsunami instantly overwhelmed the trading market. On that day, the Tokyo Stock Exchange experienced two circuit breakers due to the stock prices falling too quickly, surpassing the alert threshold.There is a saying in Japan that "when the U.S. catches a cold, Japan gets the flu." A minor change in the United States can cause a significant shock in Japan, and the emergence of "Black Monday" is naturally attributed to the U.S. by the Japanese media.

03

"Short Selling" and "Buying on Margin" in the Japanese Stock Market

The U.S. factor indeed has a significant direct impact on the Japanese stock market to a considerable extent. However, the prosperity of the Japanese stock market in recent years should be the result of the Japanese government's efforts to promote the development of the stock market. The ultimate cause of this financial earthquake should be the serious disconnection between finance and the real economy.

Since taking office as the Prime Minister of Japan in 2022, Fumio Kishida has vigorously promoted the "NISA" (Nippon Individual Savings Account) system, which allows for tax-free small investments. For example, in the past, if one made a profit of 100,000 yen from investments, they would have to pay 20,000 yen in taxes. However, with the implementation of NISA, if the profit is only 100,000 yen, one can keep the entire amount without paying any taxes.

The Bank of Japan regularly announces the total financial assets of the Japanese public. The results show that these assets have been maintained at over 2,000 trillion yen for many years. After the collapse of the bubble economy, the Japanese public has distanced themselves from the securities market, with most of their financial assets deposited in banks.

Kishida's idea is to put hundreds of trillions to 1,000 trillion yen of financial assets to use, such as investing in the Japanese stock market, which could bring about a significant boom, providing companies with ample investment capital; investing in the international financial market could demonstrate Japan's economic strength and make the world take notice.

In January 2024, NISA further expanded the tax-free investment scope, allowing more funds to enter the stock market. From January to July 11th, the Japanese stock market has been on a nearly straight upward trajectory, surpassing its historical peak.

After obtaining sufficient capital from the stock market, have Japanese companies started to invest in equipment? The answer is "no." Whether it's automotive or trading companies, after continuously receiving funds from the stock market, they have started to aggressively buy back their own shares, creating scarcity and driving up stock prices.

Japan was once an advanced country in information and communication technology (IT), but it is still at the 4G stage, with little research and development in 5G, and no significant investment. Japan is a pioneer in the development of lithium-ion batteries, but there are almost no super battery factories in the country. Companies like Panasonic and Toyota mainly invest in batteries in the United States, and their investment scale and production capacity cannot compare with Chinese companies.Japan was one of the first countries in the world to achieve the electrification of automobiles, yet in 2023, the number of electric vehicles sold in Japan for the entire year was only tens of thousands, never exceeding 2% of the total new car sales, and for several years, most months hovered around 1%.

It is only in the semiconductor field, where there is an emphasis on confrontation with China, that Japan has not only supported Taiwan Semiconductor Manufacturing Company (TSMC), a Chinese Taiwan enterprise, to invest in Japan but has also actively supported domestic Japanese companies in their semiconductor investments. Prime Minister Kishida hopes to reorganize the semiconductor industry to regain a technological advantage over China.

However, it is the investment in Japan's semiconductor industry that suffered the most significant losses in this financial earthquake, losing ground financially before it could achieve scale.

After 2024, the sudden stock market boom in Japan was a result of promoting the NISA system and revitalizing Japan's semiconductor industry policy.

However, in just about three weeks up to August 5th, Japanese stock prices fell by a quarter, and ordinary Japanese citizens using the NISA system suffered heavy losses. According to data released by the Tokyo Stock Exchange on August 16th, the characteristic of Japanese individual investors in the stock market up to August was to go long, which led to an unprecedented appreciation of stock prices. After entering August, the actions of Japanese individual investors shifted to short selling, and at the lowest point of the stock prices, they sold the stocks they had bought at high prices. According to the data released by the Tokyo Stock Exchange, the total amount of stocks sold by Japanese individual investors in the first week of August was 55.3 billion yen.

After August 6th, it was foreign institutional investors who quickly entered the Japanese stock market to take over. Also, according to data released by the Tokyo Stock Exchange, in the first week of August, foreign institutional investors took the path of going long, buying a total of 495.3 billion yen worth of Japanese stocks. The short-selling actions of foreign capital to a considerable extent protected the Japanese stock market from further plummeting, and on the 6th, there was even a "reversal" phenomenon where there were so many buyers that the stock market was suspended due to a circuit breaker.

As for international investors like Warren Buffett, who have been using interest-free yen to borrow yen and invest in the Japanese stock market since August 2020, even if the Nikkei index falls to 31,000 points, it is still 30-40% higher than the 23,000 points in August 2020. Stock prices above 37,000 points have made foreign investors earn a steady profit.

The NISA system has driven up Japanese stock prices, causing the Japanese real economy and finance to become increasingly disconnected. Under the economic security system, the Japanese government's semiconductor revitalization plan seems to be revitalizing the Japanese industry, but in reality, it does not allow enterprises to combine with the Chinese market, preventing the development of the real economy from an industrial policy perspective, and further separating the real economy from finance. Japanese economic policies will ultimately lead to financial earthquakes as soon as there is a slight movement in the stock market.

Not only Japan, but also the United States and Europe have a severe lack of investment in the real economy, technological innovation, business revolution, and product renewal, which is reflected in the financial market as a false prosperity, and there is a potential for turmoil at any time.

The "Black Monday" of 1987, or looking further back, reviewing the financial crisis of 1929, both started with a sharp drop, followed by a miraculous recovery of the stock market, then another adjustment, and before the rebound could happen, a new adjustment came, leading to a comprehensive depression of the stock market and financial markets.On August 5, 2024, the sharp decline in the Japanese stock market and its subsequent partial recovery will have what impact on the economy in the coming months and years, which requires our continuous observation. However, the further contraction of the global economy in the future is a result that can be roughly anticipated at present.

Comments