On August 29th, Masanari Takada from J.P. Morgan's Global Quantitative and Derivatives Strategy division and his team released a report stating that, as of the end of July, U.S. active funds shifted to an overweight position in Japanese equities for the first time in 20 years, while Asian funds reduced their long positions in Japanese stocks.

J.P. Morgan indicated that, based on data up to July, the key factors for active funds in deciding whether to invest in Japanese stocks may have changed, with a new order of: Micro (mainly U.S. funds), Momentum (mainly Asian funds), and Macro (mainly European funds).

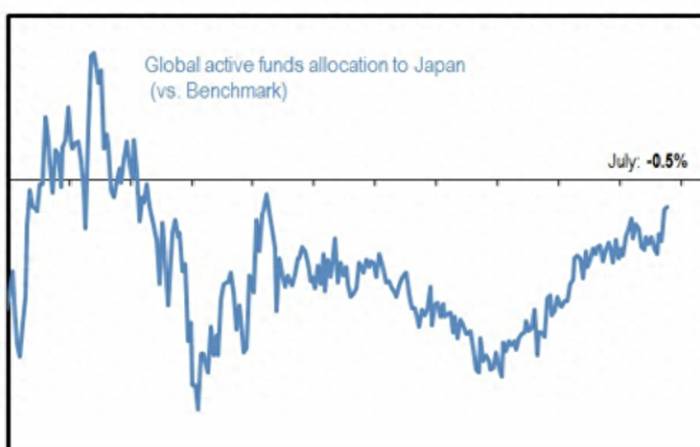

Overseas funds' holdings of Japanese stocks drop to the lowest since 2011

According to EPFR data, global active mutual funds held 0.5 percentage points underweight in Japanese equities compared to the benchmark, the lowest level since June 2011. During the "Japanese stock market boom" in April 2023, the weight of Japanese stocks held by active funds remained at -1.0 percentage points, showing no significant signs of increase.

However, since April of this year, the momentum effect has weakened, and speculative short-term investors have gradually withdrawn from the Japanese market. In this environment, active funds have been looking for high-quality equities with more reasonable prices.

Advertisement

Will active funds buy Japanese stocks in August?

Despite the "Volmageddon" in the Japanese market this month, active funds are likely to continue adjusting their underweight positions in Japanese stocks by purchasing them.

J.P. Morgan pointed out that active funds emphasizing a long-term investment perspective often have this characteristic: focusing on the medium-term growth potential of the Japanese economy (i.e., the expected potential growth rate) to adjust the fund strategy.

There is currently no sign that the trend of Japan's potential growth rate, which recovered in 2019-2020, will collapse. Therefore, J.P. Morgan believes that high-quality stocks have a market.

Although the quality factor of stocks can be directly observed, there is also a simple method to look at the JPX/Nikkei 400 Index ratio. This index has performed well since May, and J.P. Morgan speculates that active funds are currently significant buyers of these high-quality stocks.U.S. Active Funds Overweight Japanese Equities

It is noteworthy that U.S. active funds have, for the first time in nearly 20 years, taken an overweight position in Japanese equities. In contrast, European active funds are still underweight in Japanese stocks.

JPMorgan points out that, generally, U.S. active funds tend to analyze and invest in stocks from a micro perspective, such as analyzing capital costs and industry trends; whereas European active funds conduct more macro analysis.

The relative weighting of U.S. active funds indicates that they are optimistic about industries such as retail, durable goods, apparel, household goods, and personal care products, which are generally less affected by economic cycles. JPMorgan states that active funds anticipate that companies in these sectors will be able to increase prices through brand expansion and overseas expansion.

Asian Active Funds Reduce Holdings in Japanese Stocks

What about the situation with Asian funds? Based on current observations, JPMorgan notes that Asian hedge funds and Asian active funds have been reducing their long-term positions in Japanese stocks and have been re-allocating to Chinese stocks since July.

Asian investors' investment patterns are not uniform, but Citigroup summarizes that they tend to follow momentum-oriented strategies.

JPMorgan suspects that Asian hedge funds may further liquidate their Japanese equity positions this month, as the value/momentum equities favored by speculators are not only recovering slowly but may also continue to underperform in some cases.

Comments